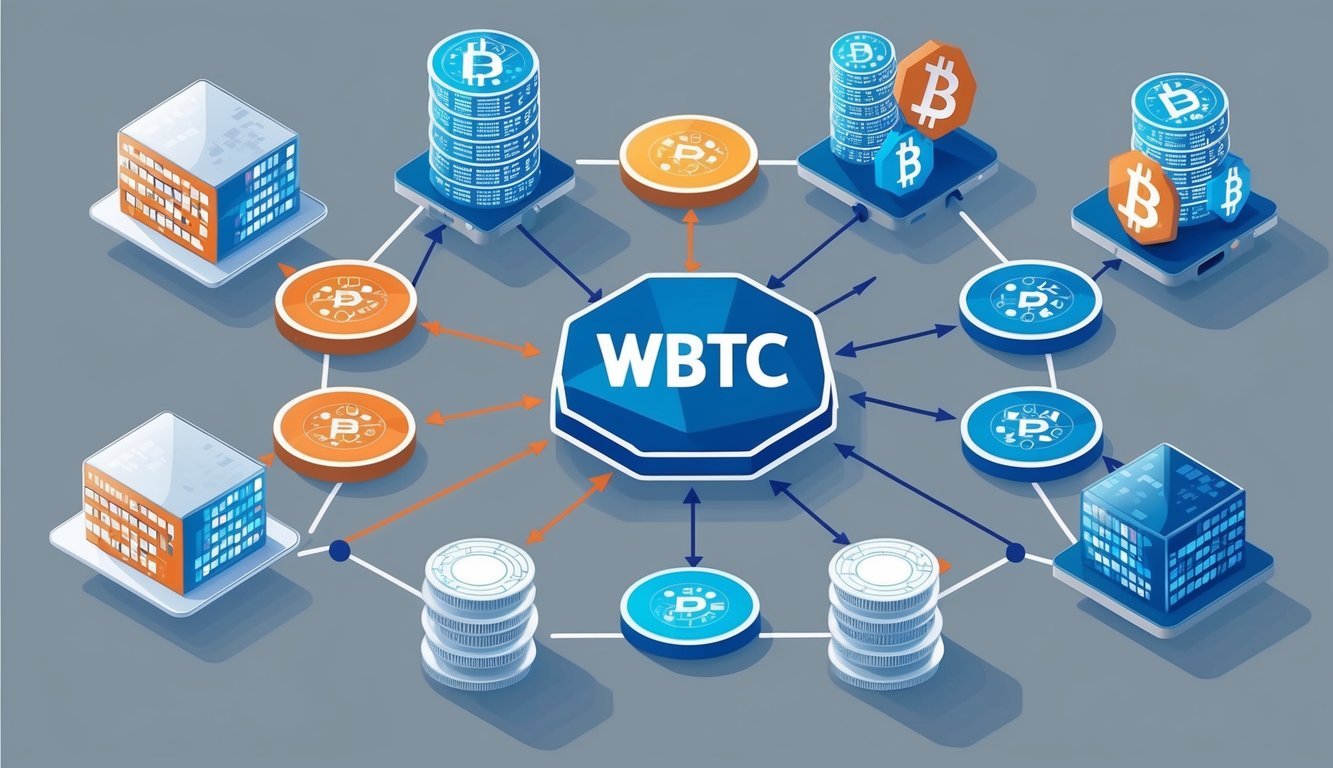

WBTC stands for Wrapped Bitcoin. It’s a special type of cryptocurrency that lets you use Bitcoin on the Ethereum network. WBTC is an ERC-20 token that represents Bitcoin on a 1:1 basis. This allows Bitcoin holders to participate in Ethereum’s decentralized finance (DeFi) ecosystem.

You might wonder why anyone would want to use Bitcoin on Ethereum. Well, it opens up a whole new world of possibilities. With WBTC, you can use your Bitcoin for things like lending, borrowing, and earning interest through various DeFi platforms. It’s like giving your Bitcoin superpowers!

WBTC was created to bridge the gap between two major blockchain networks. It allows you to enjoy the benefits of both Bitcoin’s value and Ethereum’s flexibility. This means you can hold onto your Bitcoin while still taking part in exciting DeFi activities.

Key Takeaways

- WBTC allows you to use Bitcoin on the Ethereum network

- You can swap WBTC for Bitcoin at a 1:1 ratio

- WBTC opens up DeFi opportunities for Bitcoin holders

Understanding WBTC and Its Purpose

WBTC brings Bitcoin to Ethereum, letting you use BTC in DeFi apps. It opens up new ways to use your Bitcoin and adds liquidity to Ethereum-based platforms.

The Basics of Wrapped Bitcoin

Wrapped Bitcoin (WBTC) is a special token that matches the value of Bitcoin. It’s an ERC-20 token, which means it works on the Ethereum network. For each WBTC, there’s one real Bitcoin kept safe as backup.

How does it work? You give your Bitcoin to a trusted group. They lock it up and give you WBTC in return. When you want your Bitcoin back, you trade in your WBTC.

WBTC lets you use your Bitcoin value on Ethereum. This is cool because Ethereum has lots of apps that Bitcoin doesn’t. You can lend, borrow, or trade with your WBTC just like you would with other Ethereum tokens.

The Role of WBTC in Decentralized Finance (DeFi)

WBTC is a big deal in DeFi. It brings Bitcoin’s value into Ethereum’s DeFi world. This means you can use your Bitcoin in ways you couldn’t before.

With WBTC, you can:

- Lend it out to earn interest

- Use it as collateral for loans

- Trade it on decentralized exchanges (DEXs)

- Join yield farming programs

This adds more money to DeFi apps, making them work better. It also gives Bitcoin holders new ways to make money with their coins.

WBTC helps connect different blockchains. This makes crypto more useful overall. You get the safety of Bitcoin with the flexibility of Ethereum smart contracts.

How WBTC Works

WBTC lets you use Bitcoin on Ethereum. It’s a token that matches Bitcoin’s value. You can create or destroy WBTC tokens as needed.

The Minting Process of WBTC Tokens

To get WBTC, you send Bitcoin to a custodian. They keep your Bitcoin safe. Then, they tell a smart contract to make new WBTC for you. The smart contract lives on the Ethereum blockchain.

Here’s how it works:

- You ask a merchant for WBTC

- You send Bitcoin to the custodian

- The custodian checks your Bitcoin

- They tell the smart contract to mint WBTC

- You get your new WBTC tokens

The custodian always keeps enough Bitcoin to match all the WBTC. You can check this anytime. It’s called Proof of Reserve.

The Burning Mechanism

When you’re done with WBTC, you can turn it back into Bitcoin. This is called burning. It’s like minting, but backwards.

Here’s what you do:

- Tell a merchant you want to burn WBTC

- Send your WBTC to the smart contract

- The smart contract burns your WBTC

- The custodian sends you real Bitcoin

The burning process keeps WBTC’s supply in check. It makes sure there’s always the right amount of WBTC compared to the Bitcoin held by the custodian.

WBTC’s Ecosystem and Key Players

The WBTC system involves several key players working together. You’ll find custodians, merchants, and decentralized organizations all playing important roles.

Custodians and Their Responsibilities

Custodians are a big deal in the WBTC world. They’re the ones who keep your Bitcoin safe when you swap it for WBTC.

BitGo is the main custodian for WBTC. They handle the minting process, making sure there’s always enough Bitcoin to back each WBTC token.

When you want to change your WBTC back to Bitcoin, the custodian takes care of that too. They burn the WBTC and give you back your Bitcoin.

Custodians have to be super careful with security. They use fancy tech like multi-signature wallets to keep everything safe.

The Role of Merchants and DAOs

Merchants are your go-to guys for getting WBTC. They talk to the custodians and handle the swap process for you.

Some big names in the merchant world are Kyber and Ren. They make it easy for you to get your hands on WBTC.

The WBTC DAO (Decentralized Autonomous Organization) keeps an eye on everything. They make sure the system is running smoothly and fairly.

The DAO has a bunch of members from different crypto projects. They vote on important stuff like adding new merchants or changing how things work.

There are over 40 participants in the WBTC ecosystem. It’s a big team effort to keep everything running smoothly!

Use Cases and Integration in the Crypto World

WBTC opens up new possibilities for Bitcoin holders in the Ethereum ecosystem. You can use it for lending, borrowing, and yield farming. It’s also become a key player in many DeFi protocols and apps.

Lending, Borrowing, and Yield Farming with WBTC

Want to put your Bitcoin to work? WBTC lets you do just that. You can lend it out on platforms like Aave or Compound. This way, you earn interest on your BTC without selling it.

Need a loan? Use WBTC as collateral. It’s often accepted by major lending protocols. This means you can borrow other crypto or stablecoins against your Bitcoin.

Yield farming with WBTC is another option. You can add it to liquidity pools on platforms like Uniswap. This lets you earn fees from trades and sometimes extra token rewards.

WBTC in DeFi Protocols and Applications

WBTC has found its way into many DeFi apps. On MakerDAO, you can use it to mint DAI stablecoins. This gives you a way to access dollar-pegged tokens without selling your Bitcoin.

Trading WBTC is easy on decentralized exchanges. You can swap it for other Ethereum-based tokens without leaving the blockchain.

Some protocols use WBTC in their governance. By holding WBTC, you might get voting rights in certain DeFi projects. This lets you have a say in how these protocols develop and change over time.

Frequently Asked Questions

WBTC brings Bitcoin into the Ethereum world. It lets you use Bitcoin in new ways and affects its price. You can store and trade WBTC easily.

How can you store WBTC in a wallet?

You can keep WBTC in any wallet that works with Ethereum tokens. Popular choices include MetaMask, MyEtherWallet, and hardware wallets like Ledger or Trezor.

These wallets treat WBTC like any other ERC-20 token. Just add the WBTC token address to your wallet, and you’re good to go.

What’s the connection between WBTC and Ethereum?

WBTC is an ERC-20 token on the Ethereum network. This means it follows Ethereum’s rules and can work with Ethereum-based apps.

You can use WBTC in DeFi projects, trade it on decentralized exchanges, or use it as collateral for loans. It brings Bitcoin’s value to Ethereum’s world of possibilities.

What moves the price of WBTC?

WBTC’s price usually follows Bitcoin’s price closely. When Bitcoin goes up or down, WBTC tends to do the same.

Other factors can affect WBTC’s price too. These include demand for WBTC in DeFi projects, overall market conditions, and how easy it is to mint or burn WBTC.

What’s the deal with mining WBTC?

You can’t mine WBTC like you mine Bitcoin. WBTC is created through a process called minting.

To get WBTC, you give Bitcoin to a trusted partner. They then create an equal amount of WBTC on the Ethereum network. When you want your Bitcoin back, the process is reversed.

How does WBTC ensure security for its users?

WBTC uses a system of merchants, custodians, and DAO members to keep things secure. Custodians hold the Bitcoin that backs WBTC. These custodians are responsible for ensuring that each wrapped Bitcoin is fully backed by an equivalent amount of Bitcoin held in reserve, maintaining a 1:1 ratio. This creates a level of trust and transparency in the system, allowing users to easily convert between WBTC and Bitcoin. For those exploring the crypto ecosystem further, understanding concepts like “what is husd stablecoin” can also enhance their knowledge of how different digital currencies function in the market.

Regular audits check that there’s enough Bitcoin to match all the WBTC. Smart contracts on Ethereum also help keep the system safe and transparent.

What are the options for trading WBTC on platforms like Binance?

You can trade WBTC on many crypto exchanges, including Binance. These platforms often pair WBTC with other cryptocurrencies or stablecoins.

On decentralized exchanges like Uniswap, you can swap WBTC for other Ethereum-based tokens directly from your wallet. This gives you more control over your funds.