Uniswap is a decentralized exchange that’s shaking up the crypto world. It lets you trade digital assets without a middleman. Uniswap uses an automated market maker system to set prices and provide liquidity for trades.

The platform’s native token, UNI, gives you a say in how Uniswap grows. When you hold UNI, you can vote on changes to the platform and earn rewards. It’s like being a shareholder in a decentralized crypto company.

Uniswap runs on the Ethereum blockchain, making it a key player in the DeFi space. You can swap tokens, add to liquidity pools, and even build new apps on top of Uniswap’s protocol.

Key Takeaways

- Uniswap is a decentralized exchange that lets you trade crypto without intermediaries

- UNI token holders can vote on platform changes and earn rewards

- Uniswap uses automated market makers to set prices and provide liquidity

Understanding Uniswap and Its Core Concepts

Uniswap is a decentralized exchange that lets you trade crypto tokens without a middleman. It uses smart contracts and liquidity pools to make trading easy and fast.

How Uniswap Works

Uniswap runs on the Ethereum blockchain. It uses smart contracts to let you swap one ERC-20 token for another.

You don’t need to create an account or give personal info. Just connect your crypto wallet and start trading.

When you want to make a trade, Uniswap finds the best price from its liquidity pools. These pools are filled with tokens that other users have added.

The smart contracts handle everything automatically. They calculate prices, execute trades, and update the pools.

The Role of Liquidity in Uniswap

Liquidity is super important for Uniswap. It’s what allows trades to happen smoothly.

Liquidity providers add pairs of tokens to pools. They earn fees from trades that use their tokens.

More liquidity means better prices and less price impact when you trade. It’s like having more buyers and sellers in a market.

You can become a liquidity provider too. You’ll get special tokens that represent your share of the pool.

But be careful – there are risks like impermanent loss. Make sure you understand how it works before jumping in.

Uniswap’s Automated Market Maker Model

Uniswap uses an automated market maker (AMM) model. This is different from traditional exchanges with order books.

The AMM uses a mathematical formula to set prices. It’s based on the ratio of tokens in each pool.

As people trade, the ratio changes and so do the prices. This happens automatically without anyone controlling it.

The formula Uniswap uses is called “constant product”. It keeps the product of the two token amounts constant.

This model has pros and cons. It’s simple and always provides liquidity. But it can sometimes lead to higher slippage on large trades.

UNI Token: Uniswap’s Native Cryptocurrency

UNI is the heart of Uniswap’s ecosystem. It gives you a say in how the platform runs and lets you earn rewards. Let’s look at how UNI works and why it matters to you.

Governance and UNI

With UNI tokens, you get to vote on big decisions for Uniswap. It’s like being a shareholder in a company. You can suggest changes and vote on proposals. These might be about:

- Adding new features

- Changing how fees work

- Updating the platform

The more UNI you have, the more voting power you get. This system helps keep Uniswap decentralized. You’re not just a user – you’re part of the team shaping Uniswap’s future.

UNI Tokenomics

UNI has a fixed supply of 1 billion tokens. Here’s how they’re split up:

- 60% for Uniswap community members

- 21.51% for team members (over 4 years)

- 17.8% for investors (over 4 years)

- 0.69% for advisors (over 4 years)

This distribution plan aims to reward users and ensure long-term growth. The gradual release of tokens to team and investors helps keep the price stable.

UNI’s value can change based on:

- How much people use Uniswap

- New features added to the platform

- Overall crypto market trends

Staking and Earning Fees

You can put your UNI tokens to work by providing liquidity. This means you add your tokens to trading pools. In return, you earn a share of the trading fees.

Here’s how it works:

- You deposit your UNI along with another token into a pool.

- Traders use this pool to swap tokens.

- You get a cut of the fees from these trades.

This process is called liquidity mining. It’s a way to earn passive income with your UNI. The more liquidity you provide, the more fees you can earn.

Remember, the value of your staked tokens can go up or down. Always consider the risks before jumping in.

Exchanging Crypto on Uniswap

Uniswap makes it easy to swap tokens directly from your wallet. You can trade a wide range of digital assets on the Ethereum blockchain using this decentralized exchange.

How to Swap Tokens

To swap tokens on Uniswap, you’ll need to connect a compatible wallet. Then follow these steps:

- Go to the Uniswap app

- Select the token you want to swap from

- Choose the token you want to receive

- Enter the amount you want to trade

- Review the exchange rate and fees

- Click “Swap” to complete the transaction

The process happens entirely on-chain. Uniswap uses smart contracts to match your trade with liquidity pools. This lets you swap tokens without a middleman.

Supported Wallets and Integration

Uniswap works with several popular Ethereum wallets:

- MetaMask

- Coinbase Wallet

- WalletConnect

- Fortmatic

To use Uniswap, you’ll need to connect your wallet to the app. This gives Uniswap permission to interact with your tokens. Make sure you’re on the official Uniswap website before connecting your wallet.

Understanding Trading Fees

When you swap tokens on Uniswap, you’ll pay a small fee. This fee goes to liquidity providers who make trades possible.

Uniswap V2 charges a 0.3% fee for all trades. Uniswap V3 has a more flexible fee structure. Fees can be 0.05%, 0.3%, or 1% depending on the trading pair.

You’ll also need to pay Ethereum gas fees for each transaction. These fees go to miners who process transactions on the network. Gas fees can vary a lot based on network congestion.

Before you trade, always check the total cost including fees. This helps you avoid surprises and ensure you’re getting a fair deal on your swap.

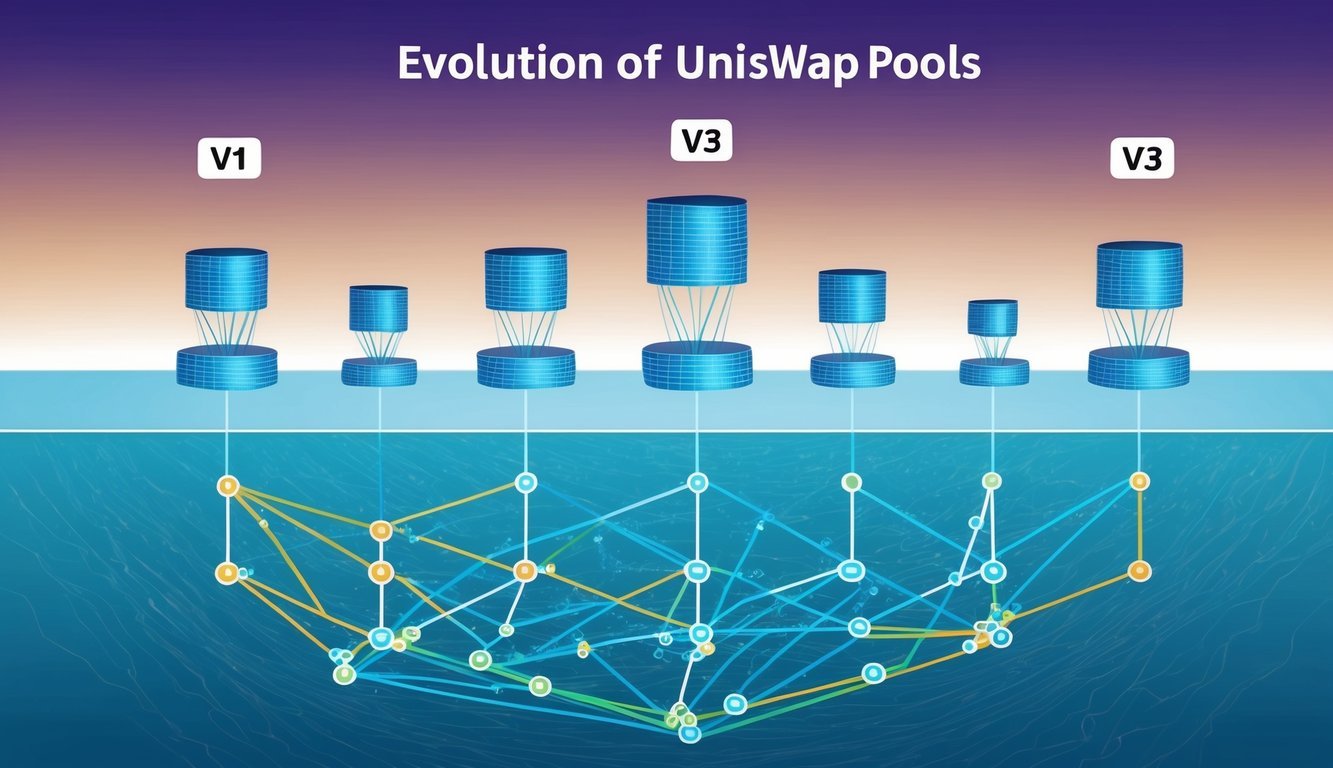

Evolution of Uniswap: From V1 to V3

Uniswap has changed a lot since it started. Each new version added cool features that made trading easier and better for users. Let’s look at how Uniswap grew from its simple beginnings to the advanced platform it is today.

Uniswap V1 and the Beginning

When Uniswap V1 launched in 2018, it was pretty basic. But it did something really important – it let you trade tokens without a traditional order book. This was a big deal!

You could swap any ERC-20 token for ETH. It used a simple formula to set prices. This made it easy for anyone to use, even if you weren’t a pro trader.

V1 was open source and permissionless. That means anyone could use it or build on it. It was a big step for decentralized finance (DeFi).

Improvements in Uniswap V2

Uniswap V2 came out in May 2020. It fixed some problems from V1 and added new stuff.

Here’s what was new in V2:

- Direct token-to-token swaps

- Price oracles

- Flash swaps

These changes made Uniswap more flexible. You could now trade way more pairs of tokens. It also became safer and more efficient to use.

V2 helped Uniswap grow a lot. More people started using it, and its Total Value Locked went up fast.

Advanced Features in Uniswap V3

Uniswap V3 launched in May 2021. It was a big upgrade that made things even better for traders and liquidity providers.

The biggest new feature was concentrated liquidity. This lets you focus your funds where they’ll work best. It’s more efficient and can earn you more fees.

Other cool V3 features:

- Multiple fee tiers

- Better price oracles

- Easier integration with layer 2 solutions

V3 made Uniswap more like pro trading platforms. But it’s still easy for anyone to use. It’s a powerful tool for DeFi that keeps getting better.

Frequently Asked Questions

Uniswap is a complex system with many moving parts. Let’s break down some common questions about how it works, its tokens, and trading on the platform.

How does Uniswap function with Ethereum?

Uniswap runs on the Ethereum blockchain using smart contracts. These contracts allow you to swap tokens without a middleman. When you trade on Uniswap, you’re interacting directly with these contracts.

You’ll need some ETH in your wallet to pay for gas fees. These fees cover the cost of processing your transaction on the Ethereum network.

Can you walk me through the process of using a Uniswap wallet?

To use Uniswap, you’ll need an Ethereum wallet like MetaMask. Here’s a quick guide:

- Set up your wallet and add some ETH.

- Go to the Uniswap website and connect your wallet.

- Choose the tokens you want to swap.

- Enter the amount and approve the transaction.

Your wallet will ask you to confirm the swap. Once you do, the trade will happen automatically.

What’s the main use of the UNI token?

The UNI token is Uniswap’s governance token. It gives you voting rights on changes to the protocol. You can also use UNI to earn rewards by providing liquidity to certain pools.

Some people trade UNI like any other cryptocurrency. Its value can go up or down based on market conditions.

Is it possible to trade on Uniswap from the USA?

Yes, you can trade on Uniswap from the USA. Uniswap is a decentralized platform, so it doesn’t have the same restrictions as centralized exchanges.

But remember, you’re responsible for following your local laws. Make sure you understand any tax implications of trading crypto.

Is the UNI token considered a smart investment?

Opinions on UNI as an investment are mixed. Some see it as a way to bet on the growth of decentralized finance. Others are more cautious due to its price volatility.

Remember, all crypto investments carry risk. It’s smart to do your own research and only invest what you can afford to lose.

How secure is the Uniswap platform for trading?

Uniswap is built on Ethereum, which has a strong security track record. Several firms have audited the platform’s smart contracts.

But no system is perfect. When dealing with crypto, there’s always some risk. It’s crucial to keep your wallet secure and be cautious about which tokens you trade. Additionally, staying informed about the latest trends and updates in the cryptocurrency market can help you make better decisions. For those interested in specific assets, a trust wallet token overview can provide valuable insights into its features, benefits, and potential risks. Always remember to diversify your investments and never put in more than you can afford to lose.